Marginal tax rate calculator

At higher incomes many deductions and many credits are phased. This is 0 of your total income of 0.

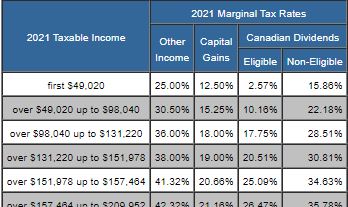

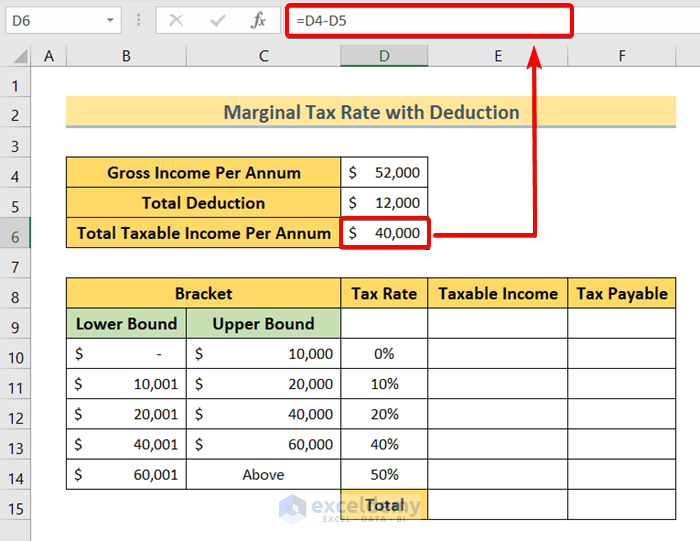

Income Tax Formula Excel University

Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

. Ad Get the Latest Federal Tax Developments. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. This calculator helps you.

At higher incomes many deductions and many credits are phased. Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. This is 0 of your total income of 0.

This is 0 of your total income of 0. Your Federal taxes are estimated at 0. In most cases your employer will deduct the income tax.

Your income puts you in the 10 tax bracket. 0 would also be your average tax rate. This is 0 of your total income of 0.

0 would also be your average tax rate. Your Federal taxes are estimated at 0. 0 would also be your average tax rate.

0 would also be your average tax rate. This is 0 of your total income of 0. 0 would also be your average tax rate.

This is 0 of your total income of 0. Your Federal taxes are estimated at 0. Your income puts you in the 10 tax bracket.

205 on the portion of taxable income over. 2016 Marginal Tax Rates Calculator. Discover Helpful Information And Resources On Taxes From AARP.

Your income puts you in the 10 tax. This is 0 of your total income of 0. For the 2016-17 financial year the marginal tax rate for incomes over 180000 includes the Temporary Budget Repair Levy of 2.

At higher incomes many deductions and many credits are phased. Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. Find out your tax brackets and how much Federal and Provincial.

At higher incomes many deductions and many credits are phased. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. 0 would also be your average tax rate.

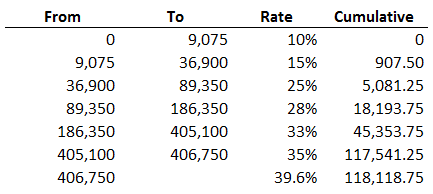

Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces. Your income puts you in the 10 tax. This is 0 of your total income of 0.

This is 0 of your total income of 0. Ad Get the Latest Federal Tax Developments. At higher incomes many.

0 would also be your average tax rate. 0 would also be your average tax rate. 0 would also be your average tax rate.

Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Your Federal taxes are estimated at 0. Your income puts you in the 10 tax bracket.

0 would also be your average tax rate. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Your income puts you in the 10 tax bracket.

At higher incomes many deductions and many credits are phased. Ad Our Resources Can Help You Decide Between Taxable Vs. At higher incomes many deductions and many credits are phased.

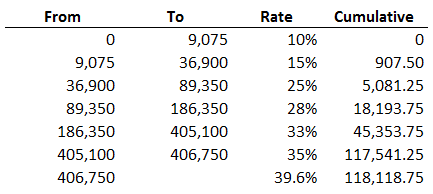

The Federal marginal tax rates for 2021 income earned is calculated as follows. Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. Marginal Tax Rate Calculator.

15 on the first 49020 of taxable income Plus. 2020 Marginal Tax Rates Calculator. Your income puts you in the 10 tax bracket.

Your income puts you in the 10 tax bracket. At higher incomes many deductions and many credits are phased. Your income puts you in the 10 tax bracket.

0 would also be your average tax rate. Your income puts you in the 10 tax bracket. Standard or itemized deduction.

This is 0 of your total income of 0. This is 0 of your total income of 0.

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

How And Why To Calculate Your Marginal Tax Rate Deliberatechange Ca

Marginal And Average Tax Rates Example Calculation Youtube

Understanding Progressive Tax Rates Ag Decision Maker

Income Tax Formula Excel University

Income Tax Formula Excel University

Taxtips Ca Alberta 2020 2021 Personal Income Tax Rates

Effective Tax Rate Formula And Calculation Example

Effective Tax Rate Formula And Calculation Example

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

How To Calculate Marginal Tax Rate In Excel 2 Quick Ways Exceldemy

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Marginal Tax Rate Formula Definition Investinganswers

Excel Formula Income Tax Bracket Calculation Exceljet

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Excel Formula Income Tax Bracket Calculation Exceljet

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube